Sign Up With Cheyenne Federal Credit Union: Member-Focused Financial Solutions

Sign Up With Cheyenne Federal Credit Union: Member-Focused Financial Solutions

Blog Article

Empower Your Funds With a Federal Cooperative Credit Union

In today's ever-evolving financial landscape, individuals are frequently looking for means to optimize their monetary wellness. One opportunity that typically continues to be underexplored is the realm of federal credit score unions. These establishments supply a special approach to financial that prioritizes the needs of their participants most importantly else. With a focus on giving affordable interest rates, personalized solution, and a diverse series of monetary products, government lending institution have actually become a viable choice to conventional business banks. By diving into the globe of government cooperative credit union, individuals can unlock a host of advantages that might just transform the means they handle their financial resources.

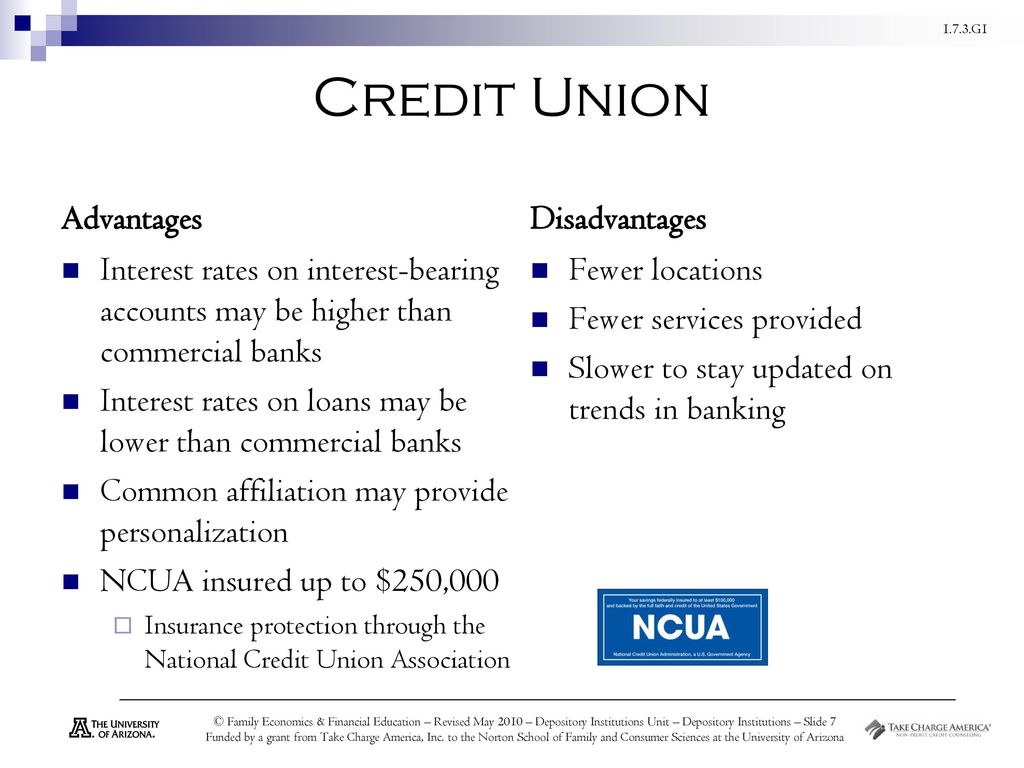

Advantages of Joining a Federal Credit Score Union

Joining a government debt union presents countless benefits for individuals seeking financial stability and personalized banking services. Unlike conventional financial institutions, government credit scores unions are not-for-profit companies owned and run by their participants.

Additionally, federal cooperative credit union are recognized for their extraordinary customer support. Participants can expect a more customized experience, with personnel that are devoted to helping them achieve their economic objectives. Whether it's looking for a finance, establishing a savings strategy, or just looking for economic recommendations, government credit unions are committed to offering the assistance and guidance that their members need - Cheyenne Federal Credit Union. Generally, joining a federal cooperative credit union can cause a much more monetarily safe future and a more favorable banking experience.

How to Join a Federal Credit Rating Union

To come to be a participant of a Federal Lending institution, individuals need to satisfy specific eligibility standards developed by the establishment. These standards commonly consist of aspects such as place, work status, membership in specific companies, or coming from a particular neighborhood. Federal Cooperative credit union are recognized for their comprehensive subscription policies, frequently allowing people from a vast variety of backgrounds to sign up with.

If you fulfill the eligibility needs set forth by the organization,The first action in joining a Federal Debt Union is to establish. This information can generally be found on the credit rating union's site or by contacting their subscription department directly. Once qualification is verified, people can proceed with the subscription application process, which might include filling in an application form and supplying proof of qualification.

After sending the needed documents, the lending institution will assess the application and alert the individual of their subscription standing. Upon approval, brand-new members can start delighting in the advantages and services supplied by the Federal Lending Institution. Joining a Federal Debt Union can supply people with accessibility to competitive financial products, individualized customer care, and a sense of area participation.

Handling Your Cash Effectively

Reliable management of personal funds is critical for attaining lasting financial security and protection. To properly handle your cash, start by creating a spending plan that details your income and expenses. This will certainly help you track where your money is going and identify areas where you can potentially conserve. Setting monetary objectives is an additional crucial element of finance. Whether it's saving for a huge purchase, constructing a reserve, or preparing for retired life, having clear goals can direct your financial choices.

Frequently reviewing your economic circumstance is vital. Put in the time to examine your budget, track your investing, and make modifications as needed. Take into consideration automating your cost savings and costs repayments to guarantee you remain on track. It's additionally a good idea to build a reserve to cover unanticipated costs and prevent entering into financial obligation. Additionally, staying informed regarding economic issues, such as rates of interest, investment choices, and credit report, can assist you make educated choices and expand your riches in time. By managing your cash effectively, you can function towards accomplishing your financial objectives and safeguarding a steady future.

Financial Services Provided by Federal Cooperative Credit Union

Federal lending institution supply a series of financial solutions customized to satisfy the varied needs of their participants. These solutions commonly include cost savings and inspecting accounts, lendings for various functions such as vehicle loans, home loans, personal loans, and debt cards - Cheyenne Federal Credit Union. Participants of government credit score unions can likewise gain from investment solutions, retirement preparation, recommended you read insurance products, and economic education and learning sources

Among the vital benefits of making use of monetary solutions offered by federal credit score unions is the individualized strategy to participant demands. Unlike conventional banks, credit history unions are member-owned, not-for-profit institutions that prioritize the financial wellness of their members most importantly else. This member-centric focus commonly converts into lower costs, affordable rates of interest, and much more flexible financing terms.

In addition, government credit rating unions are understood for their community-oriented approach, often offering support and resources to aid members achieve their monetary goals. By providing a detailed suite of financial solutions, government credit history unions empower their participants to make audio monetary decisions and work in the direction of a secure monetary future.

Maximizing Your Financial Savings With a Credit Rating Union

When seeking to enhance your savings method, checking out the potential advantages of straightening with a credit rating union can offer useful chances for monetary development and stability. Lending institution, as member-owned economic cooperatives, focus on the wellness of their participants, commonly providing higher passion rates on financial savings accounts contrasted to conventional financial institutions. By making use of these affordable rates, you can make the most of the development of your savings with time.

Furthermore, lending institution commonly have reduced charges and account minimums, permitting you to maintain more of your financial savings functioning for you. Some cooperative credit union also offer special savings programs or accounts created to assist members get to details financial goals, such as conserving for a retired life, education, or home.

Moreover, credit rating unions are recognized for their individualized solution and dedication to economic education. By have a peek at this website constructing a partnership with your credit report union, you can get to professional guidance on saving approaches, investment choices, and more, empowering you to make educated choices that align with your financial goals. Generally, optimizing your savings with a credit score union can be a clever and reliable way to expand your wealth while securing your economic future.

Verdict

Finally, joining a federal debt union can equip your finances by providing reduced rates of interest on loans, higher rate of interest on interest-bearing accounts, and customized customer care. By making the most of the Clicking Here monetary services offered, managing your cash successfully, and optimizing your cost savings, you can construct wide range and safeguard your monetary future. Consider signing up with a federal credit scores union to experience the benefits of a member-focused approach to financial wellness.

Whether it's applying for a loan, setting up a cost savings strategy, or simply looking for financial guidance, federal credit score unions are committed to providing the support and guidance that their participants require (Cheyenne Federal Credit Union). Signing Up With a Federal Credit rating Union can supply individuals with accessibility to affordable economic products, personalized client service, and a sense of neighborhood involvement

Federal credit unions offer a range of financial services customized to meet the varied requirements of their members. Members of federal credit history unions can additionally profit from financial investment solutions, retired life planning, insurance policy items, and economic education sources.

Report this page